Outsourcing and offshoring remain major drivers of business strategy in the United States. Even though many Americans express concern about jobs being moved overseas, companies continue to expand their global operations. This raises a critical question. If outsourcing negatively affects U.S. workers, why do companies keep doing it?

The answer is a mix of economics, talent gaps, tax rules, and global competition. The incentives that encourage outsourcing are significantly stronger than the incentives that discourage it.

This article breaks down the financial motivations, the structural forces, the impact on workers, and the reforms that could shift corporate behavior.

Understanding Outsourcing and Offshoring

Before analyzing the causes and effects, it helps to understand two important terms.

Outsourcing

Hiring an external provider for work that could be done in-house. This can happen within or outside the United States.

Offshoring

Relocating business functions to another country. Offshoring may involve third-party outsourcing companies or company-owned overseas facilities.

This article focuses on offshore outsourcing because it is the area most closely connected to U.S. job displacement.

Why Outsourcing Remains Attractive to Companies

Cost Savings Are the Strongest Driver

Labor costs in the United States are significantly higher than in many countries. Companies routinely save 50 percent to 70 percent when roles are outsourced to lower-cost economies.

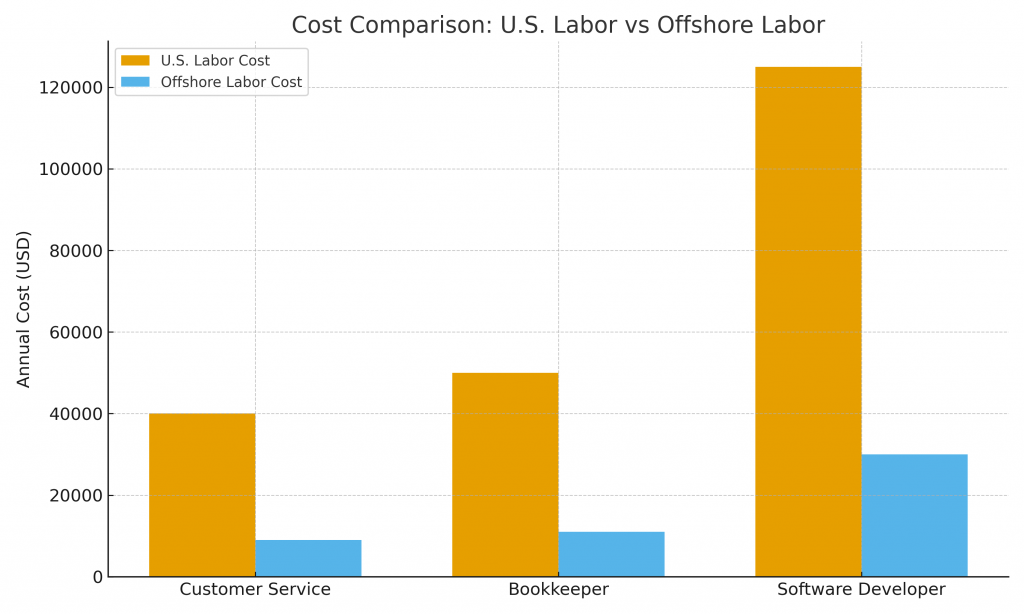

Examples of cost differences:

-

Customer service: U.S. 35,000 to 45,000 USD per year versus offshore 6,000 to 12,000 USD

-

Bookkeeping: U.S. 45,000 to 55,000 USD versus offshore 8,000 to 14,000 USD

-

Software development: U.S. 100,000 to 150,000 USD versus offshore 20,000 to 40,000 USD

Companies also reduce expenses related to recruitment, training, healthcare, benefits, payroll taxes, and physical office space.

Demand for Skills That Are Scarce or Expensive in the U.S.

Outsourcing has expanded far beyond customer service. Companies now offshore:

-

Software engineering

-

Data analysis

-

Cybersecurity

-

Accounting

-

Back-office operations

-

Creative and digital marketing

-

Medical and insurance billing

-

Research and development

Many U.S. industries report talent shortages and high local salary requirements. Outsourcing allows them to access specialized skills at lower cost and higher scalability.

Executives Expect Outsourcing to Increase

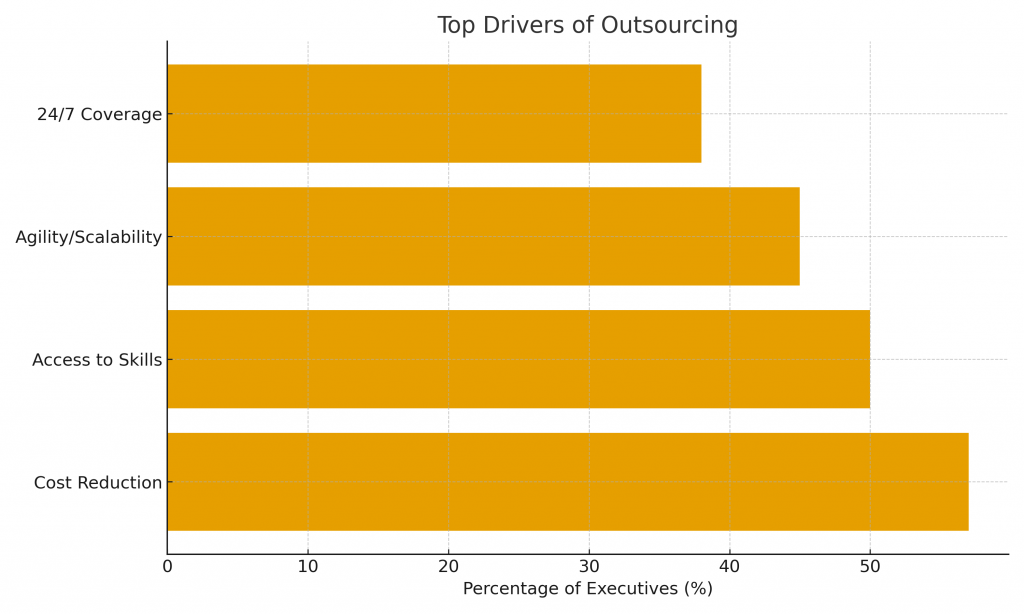

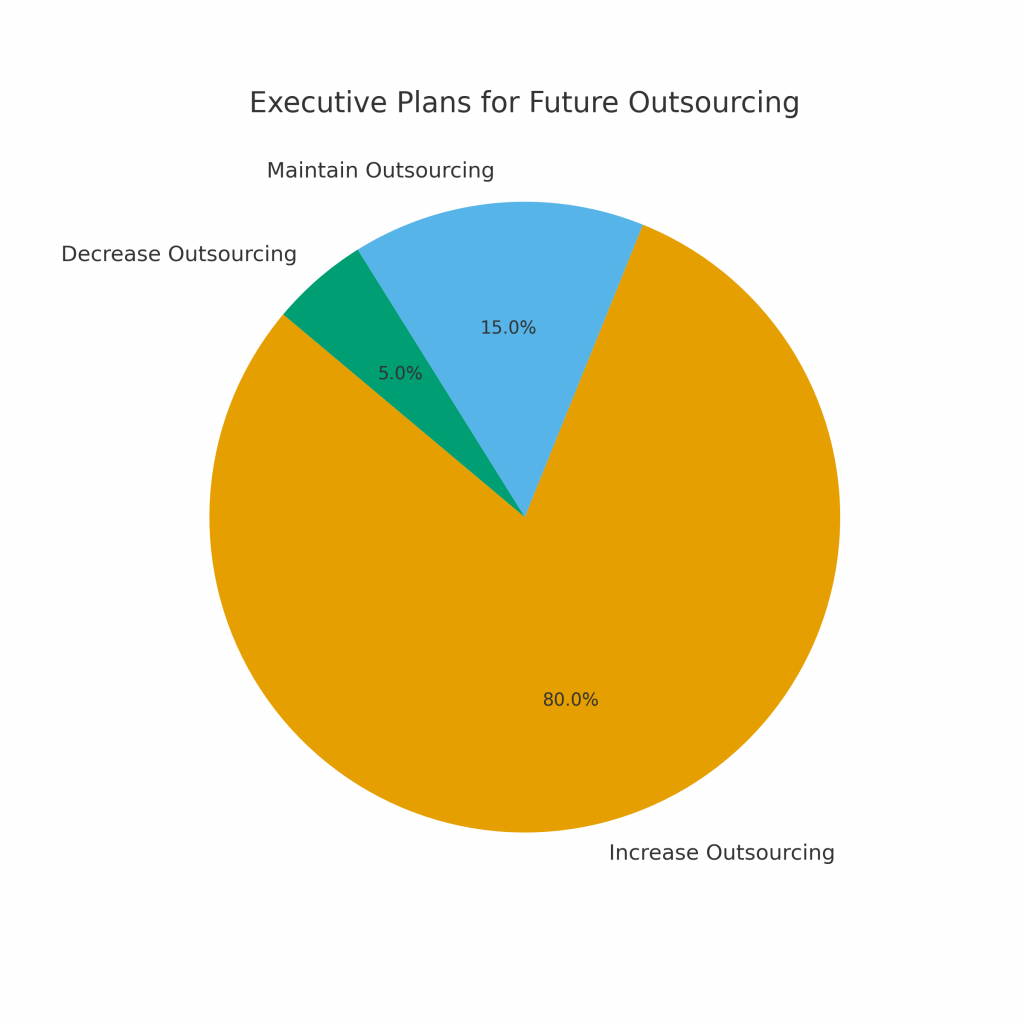

Studies show:

-

About 80 percent of executives plan to maintain or increase outsourcing

-

Outsourcing is expanding from back-office to front-office roles

-

Only a small percentage expect to reduce their outsourcing footprint

This reinforces a clear trend. Outsourcing is still growing in strategic importance.

The Impact of Outsourcing on U.S. Workers

Job Displacement: What the Data Shows

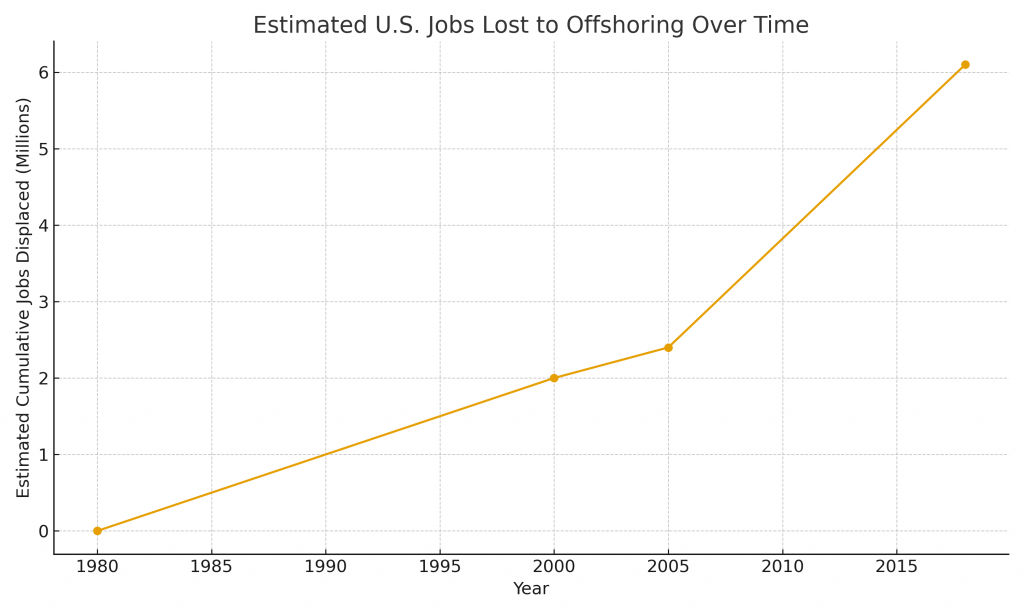

Research indicates significant job loss associated with offshoring.

-

About 2 million manufacturing jobs offshored since the early 1980s

-

Around 400,000 service jobs moved offshore in the early 2000s

-

Approximately 3.7 million jobs displaced from 2001 to 2018 due to trade deficits with China, which includes offshoring effects

These numbers represent direct job losses. They do not include indirect effects such as reduced local spending, business closures, or community decline.

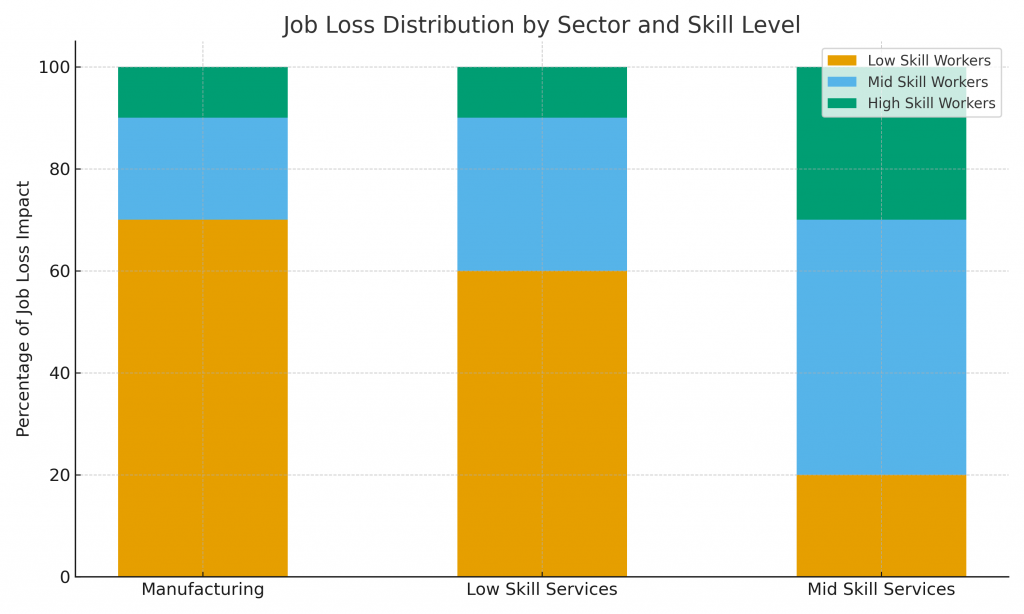

Which Workers Are Affected Most

Research shows unequal distribution of harm.

Manufacturing losses hit:

-

Manual laborers

-

Non college educated workers

-

Midwestern and Southern industrial regions

Service job losses affect:

-

Call centers

-

Customer support

-

Accounting and billing roles

-

Technical support staff

OECD studies also point to downward pressure on wages for workers competing with offshored roles.

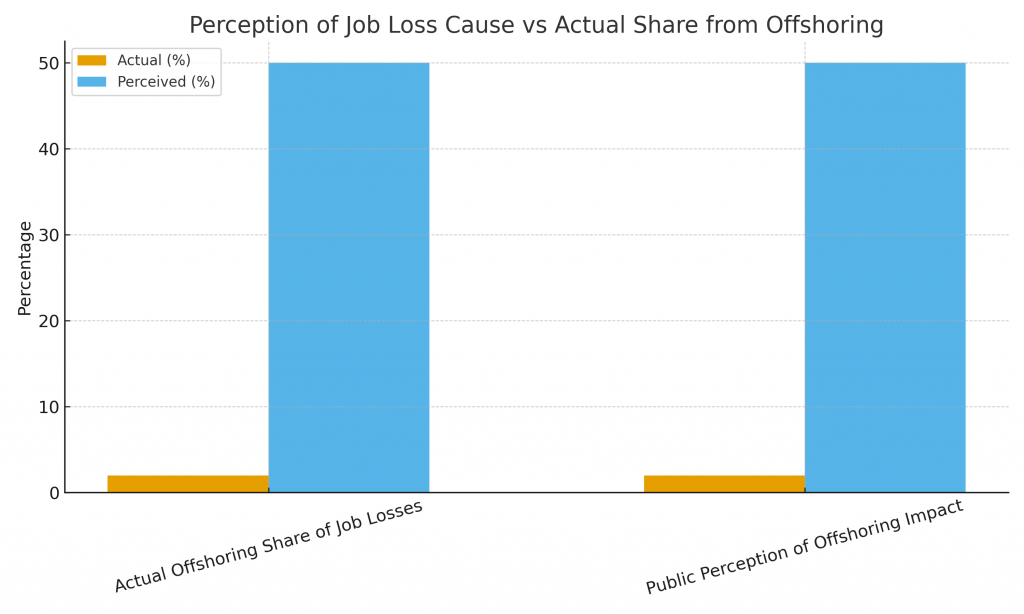

The Psychological Impact

Even though offshoring accounts for fewer than 2 percent of all involuntary job losses annually, many Americans believe it is one of the biggest drivers of unemployment. This belief amplifies political pressure even when outsourcing is not the sole cause of job transition.

Why Companies Continue Outsourcing Despite These Costs

Shareholder Pressure Dominates Decision Making

U.S. companies operate under strong expectations for:

-

Quarterly profit growth

-

Margin improvement

-

Share price performance

Outsourcing cuts costs quickly, which makes quarterly results look stronger. Investors reward these gains, and executives are tied to metrics that favor cost cutting.

Competitive Pressure Creates a Domino Effect

If competitors outsource and achieve lower operating costs, companies that do not outsource face:

-

Lower profit margins

-

Reduced price competitiveness

-

Lower returns for investors

-

Slower ability to scale

In many industries, outsourcing is no longer optional. It is a competitive necessity.

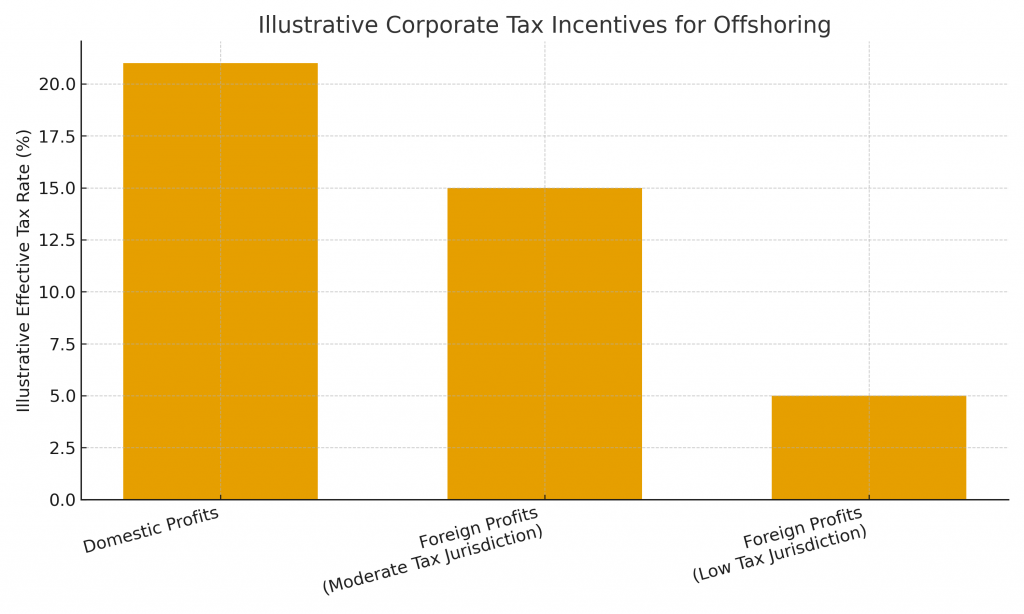

Tax Rules Can Encourage Offshoring

Current tax structures allow:

-

Lower effective tax rates on certain foreign earnings

-

Profit shifting through international entities

-

Financial benefits for maintaining offshore subsidiaries

Critics argue that the 2017 U.S. tax reform unintentionally rewarded offshoring. Proposed legislation that would apply new taxes on outsourced labor is still in early stages and has not changed corporate behavior.

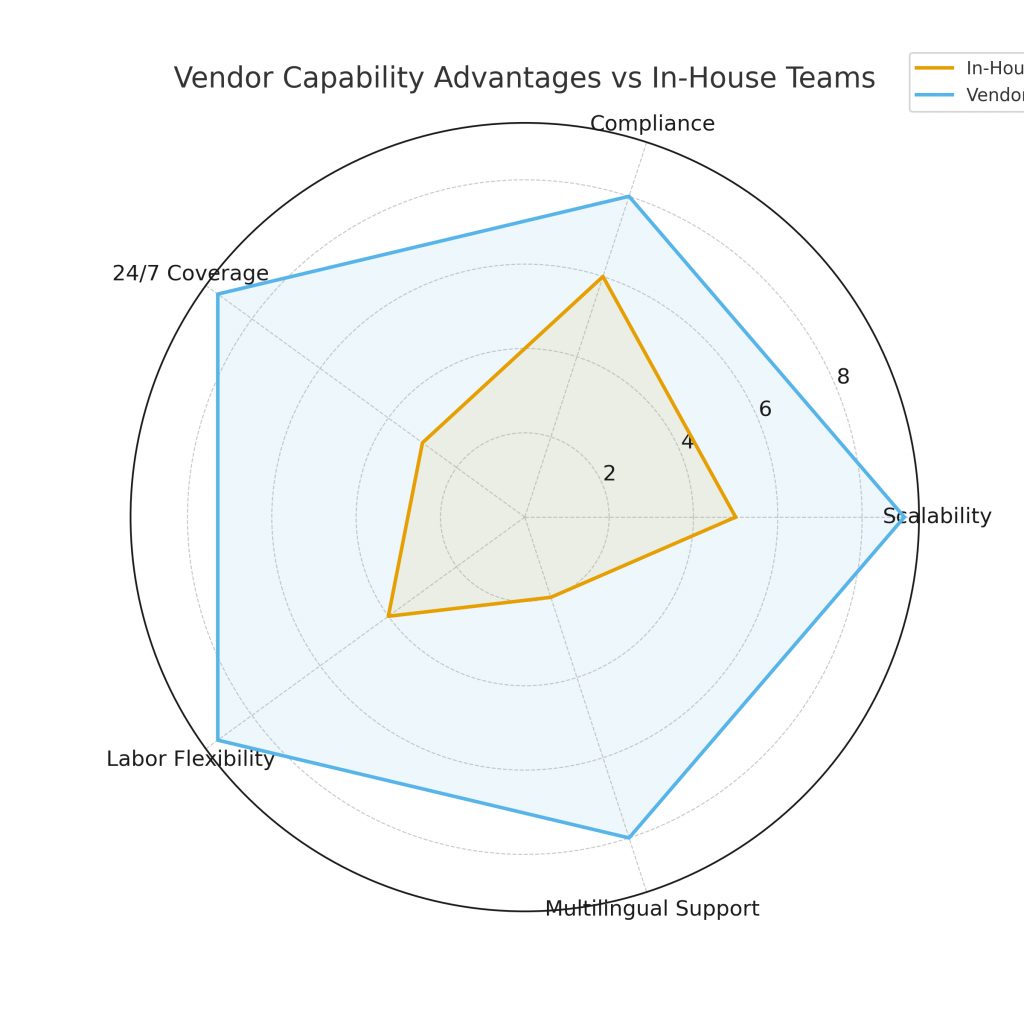

Global Vendors Offer Capabilities Hard to Replicate In-House

Outsourcing providers supply:

-

24 hour operations

-

Rapid scalability

-

Multilingual staffing

-

Compliance frameworks

-

Cybersecurity systems

-

Specialized management layers

Building this infrastructure domestically is expensive and slow.

Technology Removes the Barriers of Distance

Modern tools make global work possible:

-

Cloud platforms

-

Real-time communication apps

-

Shared digital workspaces

-

Automation software

-

AI assisted workflows

Most knowledge work no longer requires physical proximity.

Counter Trends: Reshoring and Nearshoring

Some companies are bringing operations closer to home due to:

-

Supply chain risk

-

Geopolitical instability

-

Rising offshore wages in certain countries

-

Government incentives

-

Consumer preference for domestic production

Although reshoring is growing in manufacturing, it remains much smaller than total offshoring volume.

Chart Placeholder 9: Reshoring vs Offshoring Trend Line

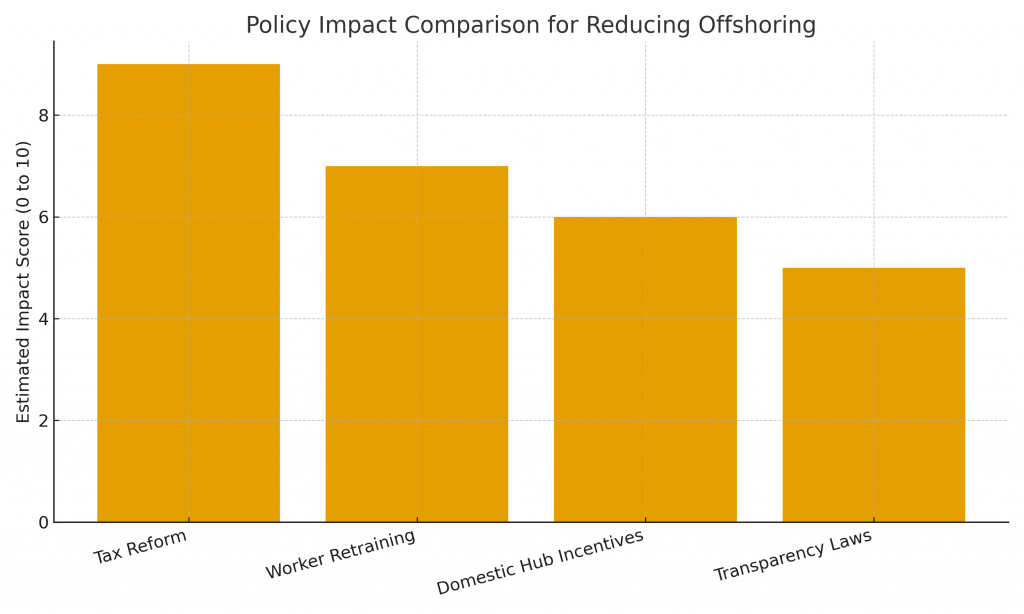

What Could Actually Change Corporate Behavior

Tax Reform

Potential reforms include:

-

Removing benefits for profit shifting

-

Applying equal tax rates to foreign and domestic earnings

-

Tax penalties for specific offshored job categories

Worker Retraining and Wage Support

Programs could focus on:

-

Job placement

-

Technical retraining

-

Wage insurance

-

Regional development grants

Incentives for Building U.S. Hubs

Government incentives could support:

-

Domestic manufacturing centers

-

Shared service hubs

-

Research facilities

-

Innovation clusters in smaller cities

Transparency Requirements

Companies could be required to disclose:

-

Offshore staffing counts

-

Percentage of labor outside the U.S.

-

Number of displaced domestic positions

Transparency could influence investor sentiment and public perception.

Conclusion

Outsourcing continues not because companies want to harm U.S. workers, but because the current incentive structure rewards global labor arbitrage. The financial benefits are immediate and measurable. The costs to American communities are gradual and diffuse.

Until tax rules, labor policies, competitive expectations, and shareholder demands shift in a meaningful way, outsourcing will remain a rational and predictable strategy for U.S. businesses.